Financial Protection: 5 Ways to Save and Grow Your Budget

Financial protection is about NZ (emergency reserve), reducing debits to credits and competent budget planning. The text is short but informative.

5 ways to play it safe:

- Calculation of expenses and incomes;

- Determination of terms for adaptation after a force majeure situation;

- Determining the minimum amount required to provide financial protection;

- Budgeting is a conscious approach;

- Planning

Let’s consider each item in more detail:

1 Learn to regularly count where your money goes

Cost accounting is the foundation on which financial protection is built. Banks that take into account the interests of the client understand this. For example, Tinkoff offers a simple smartphone application through which you can not only make money transactions, but also keep track of your expenses and income. It is very comfortable. If you have nothing to hide.

But if you do not want your financial history to be known to third parties, stop using plastic cards. Make financial transactions in cash or with cryptocurrencies. Transactions can be recorded by hand in a special notebook, in an Excel spreadsheet, or, in the case of cryptocurrencies, the blockchain system will remember and save everything. Both transaction data and your anonymity.

In general, there are many ways to account for finance. Choose the most convenient for monthly calculations. Determine how much money you spend per month and whether this amount correlates with your income. Analyze expense items to identify and eliminate "unnecessary spending". Turn them into savings by eliminating purchases that you can do without.

You can “stuff" this pillow with any amount. The cumulative effect of regular financial investments will still work for you.

What are you willing to deprive yourself of in order to organize solid financial protection?

You probably have a lot of small habits that you can easily live without: a cup of coffee with you on the way to work, an addiction to desserts with refined sugars, a bottle of foam at night, etc. Take away one small habit that is silently and imperceptibly harming your overall health and move it to another status.

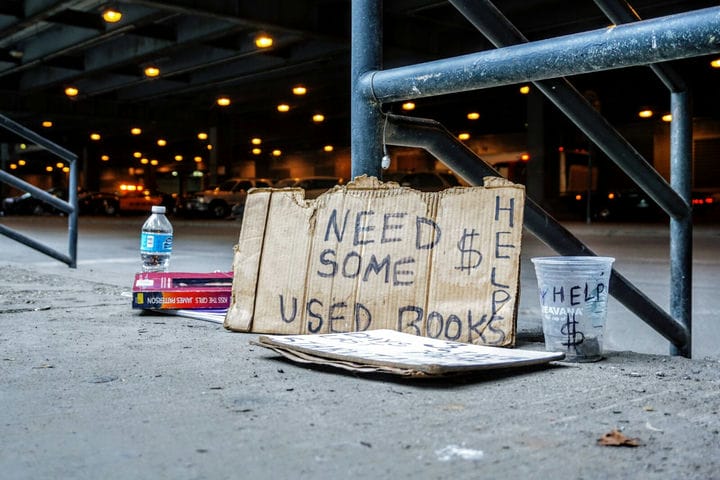

Accumulate not the effects of bad habits, but the money you spend on them. In this case, illness, job loss and other force majeure circumstances will not take you by surprise.

2 Financial protection works when you set a deadline

Remember force majeure situations from your life and calculate how long it took you to get out of them. Set a time frame to determine the amount needed to provide you with financial protection in the event of unforeseen circumstances. The standard cash reserve is a period of 6 to 12 months. This is about how long it takes to get back on your feet after losing your job, given the recent volatile job market.

3 Calculate your minimum

What is your minimum monthly budget? Multiply it by the time you need to restore systematic financial injections.

For example, 50,000 🪙 and 6 months. We multiply one by the other. 300,000 🪙 – a financial cushion for six months in advance. This is your minimum for survival.

Until you have this amount, confidence in the future will remain an abstract concept. If you care about your future, find ways to get these funds. Otherwise, you can be guaranteed safety, for example, by subsistence farming far from civilization. Your own land, farm and garden is, of course, a more reliable “cushion” than the numbers on your account. But this, again, depends on your lifestyle and plans for the future. If you travel a lot, your house and household are a burden. If you do not have your own property, then you are forced to overpay for housing every month to the landlord.

Analyze all aspects of your life. Where are you now and what do you have? What are you striving for and how long do you define to achieve the goal? Start from global long-term issues in order to build everyday life for big goals.

4 Budget Consciously

An analysis of the expense items will show where the money earned is flowing. Review your priorities. How do you eat? Where do you live? Do you have transportation? Are there children in your family? How much do you spend on leisure and hobbies? Each expense item is a piece of the puzzle from the overall picture of your life. How does your choice affect your life in general? Make a list of questions that will help you understand how vital you are at the moment, certain activities. which are essential for survival? What’s important? What is missing?

This process is not easy for everyone, but if you learn how to consciously approach spending, you will find a way to not only save, but also increase your income. By raising the standard of living, you get access to new tools for self-development, rise one step higher in your business and improve your personal qualities. There is not a single puzzle that would make up a picture of a complete picture – everything is connected.

5 Plan and you will have strong financial protection

After you have audited your financial situation, start planning. When you can see your situation clearly in the here and now, you can make a plan to strengthen financial protection.

Change habits. Revisit your beliefs. Saving is not hard. The main thing is not to get carried away by the limitations of oneself. Sudden changes do not bring results painlessly and everything has to be built anew. Therefore, do not feel sorry for yourself, but do not break through the knee. The road to success starts with small changes. For example, with one clear thought.