🏡 Investing in Real Estate in Europe: Strategies and Tips 📘

Are you considering investing in European real estate as a way to expand your investment portfolio? Explore the European real estate market here and learn about safe investment strategies that can help you minimize risk and maximize profits.

📘 Basics of investing in European real estate

Investing in real estate is a popular and proven way to generate income and capital. Europe, with its diverse and stable market, offers many opportunities for investors.

📊 Market analysis

The first step is to conduct an in-depth market analysis. Study current trends, economic indicators, and growth forecasts in the regions you are interested in.

💼 Choosing a strategy

Choosing the right investment strategy depends on your goals, risks, and time frame. Consider long-term investments for stable income or short-term projects for quick profits.

🏢 Types of real estate

Invest in different types of properties, such as residential, commercial or industrial, to diversify your portfolio and reduce risk.

| Property type | Income Potential | Risk |

|---|---|---|

| Residential real estate | Stable | Short |

| Commercial real estate | High | Average |

| Industrial real estate | Average | High |

📈 Analysis and risk management in real estate investments

Real estate investing carries risks that must be carefully analyzed and managed. Understanding and minimizing these risks is the key to successful investing.

🏢 Market fluctuations

The real estate market is subject to fluctuations. It is important to understand economic cycles and market trends to make informed decisions.

📉 Investment diversification

Diversifying your portfolio by investing in different types and locations of real estate will help reduce risk. Don't put all your eggs in one basket.

📚 Deep Learning of Objects

Before investing, it is important to conduct a detailed analysis of each property. Study the location, condition of the property, potential income and maintenance costs.

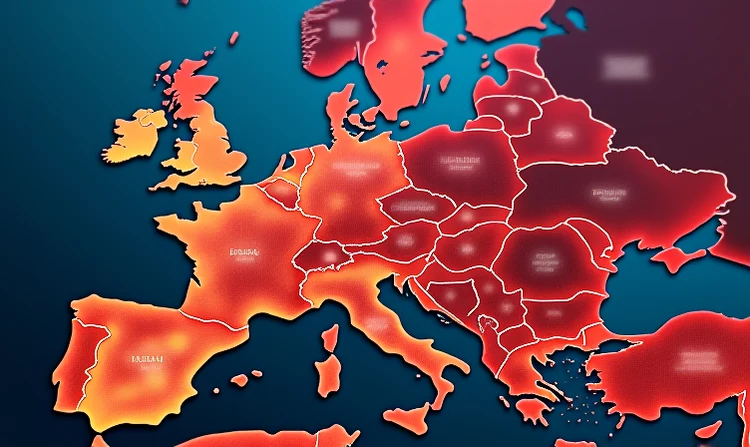

🌍 Investment opportunities in different European countries

The European real estate market offers a variety of investment opportunities in different countries. Each country has its own characteristics that can offer unique advantages to investors.

🇩🇪 Germany

Germany is renowned for its stable property market and low mortgage rates, making it an attractive option for long-term residential investment.

🇪🇸 Spain

Spain attracts investors due to its warm climate and popularity among tourists. Investing in resort real estate can be especially profitable.

🇮🇹 Italy

Italy offers unique opportunities for investment in historic properties, particularly in culturally rich regions such as Tuscany.

⁉️🤔 Popular questions and answers

- Which countries in Europe are the best for real estate investment?

Germany, Spain and Italy are often considered attractive for real estate investment due to their stability, tourist demand and unique cultural offerings.

- How to minimize risks when investing in real estate?

Risk minimization is achieved through careful market analysis, investment diversification and detailed study of each investment object.

- How important is location when choosing an investment property?

Location plays a key role as it influences demand, rental prices and resale opportunities.

💎 Results and conclusions

Investing in real estate in Europe can be a profitable and safe way to expand your investment portfolio. The main keys to success are in-depth market analysis, choosing the right strategy, risk management and diversification. Different countries in Europe offer unique investment opportunities, and choosing the right location can significantly increase your investment income potential. Careful planning and a sound investment approach can lead to significant long-term benefits.