7 Cryptocurrency Investment Strategies for Beginners

If you have the opportunity to invest in the future of new technology, here are 7 cryptocurrency investment strategies for beginners. Before you act, study them all.

7 Cryptocurrency Investing Strategies – The Zen Way

Buy bitcoin and relax

This strategy works because bitcoin is perceived by the investor community as the most stable cryptocurrency that will always rise. After all, it all started a few years ago. But is this an argument for those who plan to invest in new financial technology?

Yes. Bitcoin is the most widely used coin. This is a pioneer. He has the largest community, so the growth rate is logical. This currency has the fastest growth, an established network of exchangers, not only in the online environment. Points of purchase and sale of bitcoin exist offline.

But no one guarantees that this will always be the case. Moreover, no one really knows what will happen next.

7 Cryptocurrency Investment Strategies – Trading

predict or guess

Trading is the ability to predict which currency will gain growth, then buy it as cheaply as possible and manage to sell it profitably.

Sounds simple.

Therefore, novice investors prefer trading to other strategies at the beginning of their journey. But their main mistake is the desire to get everything at once, as well as the unwillingness to understand the essence of the issue. And they are still in a hurry. Sometimes this allows them to make profitable deals. But from a strategic point of view, these isolated victories mean nothing.

Common mistakes or why beginners should not “go" into trading

First, for a beginner, to predict means to guess. Secondly, if you are not familiar with discipline and dedication, you do not have an understanding of the topic of "risk management" – trading becomes roulette.

The probability of losing money in trading is 99% for a beginner.

The best minds of cryptanalysts are not able to 100% predict the movement of bitcoin and other currencies.

We will tell you a secret – no one knows what will happen to the cryptocurrency rate.

But beginners believe that they know, feel the trends, because they “have not yet blurred their vision.” Where such confidence? Many, many years ago, someone let out the phrase “beginners are lucky”. Since then, they have been earning quickly and losing even faster on trading. Again and again. Without understanding the essence of the issue. But not everything is so sad. Even novice traders grow into pros if they put in the effort.

There are many tools, strategies and ways to earn money for successful trading. But they work for people who have dedicated themselves to this topic – have spent months and years in practice.

Stories about successful trading do not talk about risks and losses. But if you are determined to make money quickly and also lose quickly, and you have strong nerves and an inquisitive mind, try to master this art. Trading is good if you are willing to take the time to learn, always keep an eye on the slightest changes in the market, and are able to react quickly.

But what if you're not ready? The next strategy is for those who do not have experience, time and knowledge, but have a desire to invest in the future of cryptocurrency and make money on it.

7 Cryptocurrency Investment Strategies – TOP 10

или Follow The Money

Invest in what is successful. Buy leaders. It's simple.

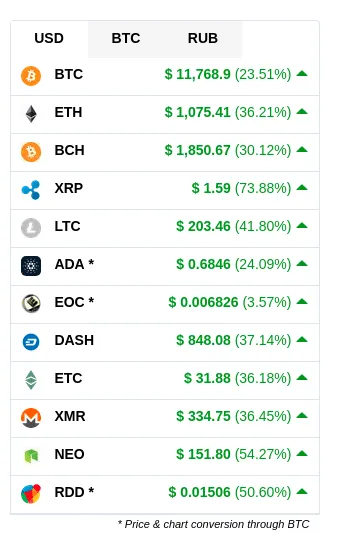

At any given time, there are coins that are stronger than others. This means that millions of investors believed in these coins and bought them. And all that is required of you is to support their choice.

Top 10 coins is a chance to profit without knowledge. 99% of traders do not get the result that a simple TOP-10 strategy gives.

This information can make you smile with healthy sarcasm – everything looks too simple. Of course, the leading coins also leave the market. But unlike other coins, they “die” slowly, which means that you will have time to make the manipulations necessary to reduce the risk of losing your assets.

There are even simpler strategies – but they are more like entertainment than conscious investment.

7 Cryptocurrency Investing Strategies – Pennistoks

Buy shitcoins and wait

Surely you know that part of the population of large cities dresses in clothing outlets. It's probably not a secret for you that there are even grocery stores where illiquid, but quite usable food products are sold.

So, cryptocurrencies are no exception. In the financial market, there is such a section of coins as “shitcoins”. These are the most unpopular and cheap coins. And they are bought.

Why buy shitcoins?

There are always investors on the market who perceive the ongoing processes as a game. In the crypto industry, this is a pool of “shit investors” who invest in the most unpopular coins. But they don't just do it for fun. “Shitcoins shoot too.”

It just doesn't happen that quickly or often. Observations show that once a year one of these currencies rises in price. And then the investor, playing the role of a "piano in the bushes", abruptly appears and sells. And makes a profit.

Such a "shitcasino" for those who are bored of seriously investing in cryptocurrencies.

7 Cryptocurrency Investment Strategies – Mining

For “kinesthetic investors”

Suitable for those who like to feel the processes at the physical level: hot air, rattling iron. The machine still looks more understandable and reliable to some people than abstract numbers that go up and down again.

7 Cryptocurrency Investment Strategies:

Mutual crypto funds

Analogues of traditional mutual funds, where a manager is selected on the site and funds are entrusted to him. He is engaged in the fact that he invests them in the crypt. You can choose a manager, find out the volume of his cash portfolio, and also check how much income he has brought to various investors.

If you find a pro, he will bring you income from 18 to 40% per month. The advantage is that this strategy has a low entry threshold. For example, the mip.capital resource has only $10. But like all high-yield instruments, the analogue of a mutual fund involves high risks.

7 Cryptocurrency Investment Strategies:

Trust management

Suitable for those who do not want or do not have free time to study cryptoeconomics, but really want to jump on the last car of this train. But he fears that, for example, without outside help, he will break his legs or fall under the wheels of the train.

This strategy is one of the most risky. Its essence is to find a team of crypto entrepreneurs, entrust them with your funds and receive income or incur losses. Management of your assets goes to a group of people who presumably know what they are doing. And I'm ready to help you earn money.

But your assets are not protected in any way here. Are you ready to start the investor's journey with delegation? Perhaps you should first understand the processes of the market before acting. You will always lose.